block input tax malaysia list

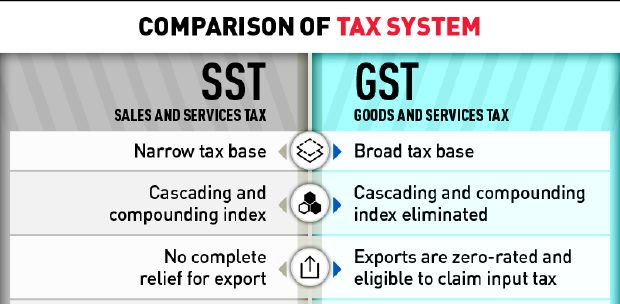

Which would be taxable supplies if made in Malaysia. I The SST will be a single-stage tax where the sales ad.

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Generate GST Return File 44 94.

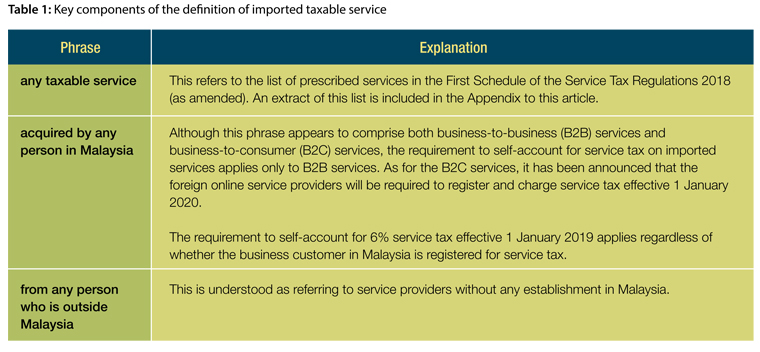

. ITC being the backbone of GST and there are many condition to claim ITC on any items. The Goods and Services Tax GST is an abolished value-added tax in Malaysia. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax.

ITC is used for payment of output tax. Resident individuals are eligible to claim the following tax rebates which are to be deducted from tax charged. Input tax incurred can be claimed in respect of the supplies made outside Malaysia which would be taxable supplies if made in Malaysia.

Family benefits for staff. Service tax that is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business. GST Processor 40 91.

Central excise duty service tax VAT luxury tax etc. Blocked credit list Section 175 1. Block Input Tax Malaysia List - Income Tax Fundamentals 2017 with HR Block Premium.

A list of No Input Tax Credit. Imposition of Sales Tax 4. Here are the details on how the SST works - the registration process returns and payment of the SST and the transitional measures to take after the abolishment of the GST.

In order for the recipient to receive a package an additional amount of. GST in Malaysia is proposed to replace the current consumption tax. For 194C 2.

Under GST businesses are allowed to claim GST incurred on purchase of most goods and services. Under section 8 of the Sales Tax Act 2018 sales tax is charged and levied on all taxable goods. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

Except customs duty that applied previously ie. Any excess is not refundable. Blocked input tax however means input tax credit that business cannot claim.

8 June 2017 Page 4 of 38 regarded as making a taxable supply and is eligible to claim GST paid or to be paid on goo ds and services acquired or imported by him input tax. Capital goods purchased from GST registered suppliers and directly attributable to taxable supplies. Bhd a GST registered International Procurement Center undertakes procurement and sale.

The Tenant AllowBlock List is used during mail flow for incoming messages does not apply to intra-org messages and at the time of user clicks. Input tax claims are allowed subject to the conditions for input tax claim. Input Tax 6 Capital Goods Acquired To Make Taxable Supplies.

Expenses for use of club facilities Eg. Blocked input tax refers to input tax credit that you cannot claim. But there are some cases where ITC is blocked so that recipient is not able to claim ITC.

You should only claim input tax in the accounting period corresponding to the date of the. RM150000 RM4000 ii The garment manufacturer is entitled to claim input tax since the value of exempt supplies is less than RM5000 per month and does not exceed 5 of the total value of all supplies. Configure Malaysia GST 9 42.

You can specify the following types of overrides. The import tax on a shipment will be. Section 175 of GST Act deals with the blocking of ITC on specified inward supplies.

From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia. Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas. However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax.

The existing standard rate for GST effective from 1 April 2015 is 6. 12017 Date of Publication. Stamp atx 65 Specific tax on certain merchandise and services 66 Public lighting tax 67.

GST incurred at 6. The flow for the configuration is such that firstly the Withholding Tax Key eg. 55 Block input VAT 60 Other taxes 61.

Purchase from a person who qualifies for Flat Rate Schemes where. In taxes will be required to be paid to the destination countries government. Sales tax is a single stage tax charged and levied on all taxable goods manufactured in or imported into Malaysia.

INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART I EXPENSES Public Ruling No. The Tenant AllowBlock List in the Microsoft 365 Defender portal gives you a way to manually override the Microsoft 365 filtering verdicts. Taxable person is any person who belongs in Malaysia and is prescribed to be a taxable person.

Supply or importation of passenger car including lease of passenger car Passenger car is defined as a motor car of a kind normally used on public roads which is constructed or adapted for the carriage of not more than nine passengers inclusive of the. Conditions for Claiming Input Tax. Accommodaoti n tax 68 Advance tax on dividend distribution 69 Import and export duties 70 Taxes on individuals 71 Personal income tax.

- We did not find results for. The basic fundamental of GST Malaysia is its self-policing features which allow the businesses to claim their Input tax credit by way of automatic deduction in their accounting system. Taxable service is any service which prescribed to be a taxable service.

Iii Malaysia - The new Sales Tax and Service Tax are effective from 1 August 2018 and replaces the Goods and Services Tax system. GST paid on some purchases are however blocked which means that the business cannot claim credit for it when submitting their monthly or quarterly GST returns. For example if the declared value of your items is.

Green fees buggy fees rental of golf bag locker and dining at club restaurants. Generate GAF 45. When purchasing from GST-registered suppliers or importing goods into Singapore you may have incurred GST input tax.

Input tax claims are disallowed under Regulation 26 of the GST General Regulations. You can claim the input tax incurred when you satisfy all of the conditions for making such a claim. GUIDE ON INPUT TAX CREDIT As at 4 JANUARY 2017.

Setting Default Tax Code 13 a Setting Default Tax Code in general 13 b Setting Default Tax Code by Stock Item 14. Run GST Processor using wizard 40 92. Individual - Other tax credits and incentives.

Property tax 62 Tax on unused land 63 Registration tax transfer tax stamp duty 46. If husband and wife are separately assessed and the chargeable income of each does not exceed MYR 35000. Journal Entry 39 9.

194C is to be created then under that Withholding Tax type is created one at the time of invoice and other at the time of payment and then based on the different rates prevailing in the Income tax Act different Tax Codes are to be created eg. Cash Payment Blocked input tax 38 84.

Gst Input Tax Credit Reconciliation Eligibility Documents Software Required

Gst Better Than Sst Say Experts

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

List Of Business Expenses On Which Input Vat Is Blocked

Malaysia Gst Blocked Input Tax Credit Goods And Services Tax

Malaysia Gst Blocked Input Tax Credit Goods And Services Tax

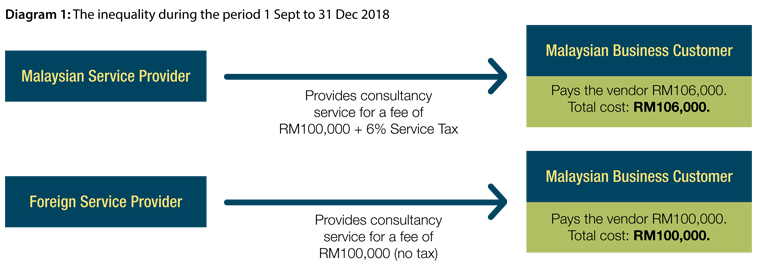

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Gst Better Than Sst Say Experts

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group